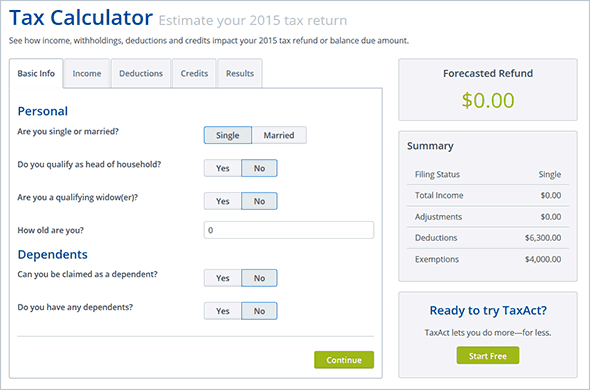

Expected tax return calculator

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Prepare and e-File your.

How To Calculate Taxable Income H R Block

In this past fiscal year Fiscal Year 2022 FY22 Massachusetts tax revenue collections exceeded the annual tax revenue cap set by Chapter 62F of the Massachusetts General Laws.

/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

. 2021 Tax Year Return Calculator in 2022. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Estimate your federal income tax withholding.

Did you withhold enough in taxes this past year. The estate tax in Minnesota currently applies to taxable estates worth more than 3 million. See how your refund take-home pay or tax due are affected by withholding amount.

This calculator will help you work out your tax refund or debt estimate. 15 Tax Calculators. This tax calculator is solely an estimation tool and should only be used to estimate your tax liability.

Simply enter your numbers and our tax calculator will do the maths for you. Effective tax rate 172. How It Works.

Instantly work out your estimated tax return refund. Estates with a taxable value greater than that amount must file an estate. Everything is included Premium features IRS e-file 1099-MISC and more.

It can be used for the 201516 to 202122 income years. This 2021 Tax Return and Refund Estimator provides you with detailed Tax Results during 2022. Over a decade of business plan writing experience spanning over 400 industries.

2022 Tax Calculator Estimator -. Click here for a 2022 Federal Income Tax Estimator. Ad Being an Industry Leader is Earned Not Given Business Planning Simplified.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal income tax brackets and rates. Use this calculator to help determine whether you might receive a tax refund or still owe.

To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and. Based on your projected tax withholding for the year we can also estimate your tax refund or. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Nonresident aliens use Form 1040-ES NR to figure estimated tax. Then get Your Personal Refund. W-4 Pro - Tax Return Based W-4 Form.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Use this tool to. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

Australian TAX RETURN and TAX REFUND CALCULATOR. Before you use the. Estimate Your 2022 Tax Refund For 2021 Returns.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. This calculator is for 2022 Tax Returns due in 2023. Enter your filing status income deductions and credits and we will estimate your total taxes.

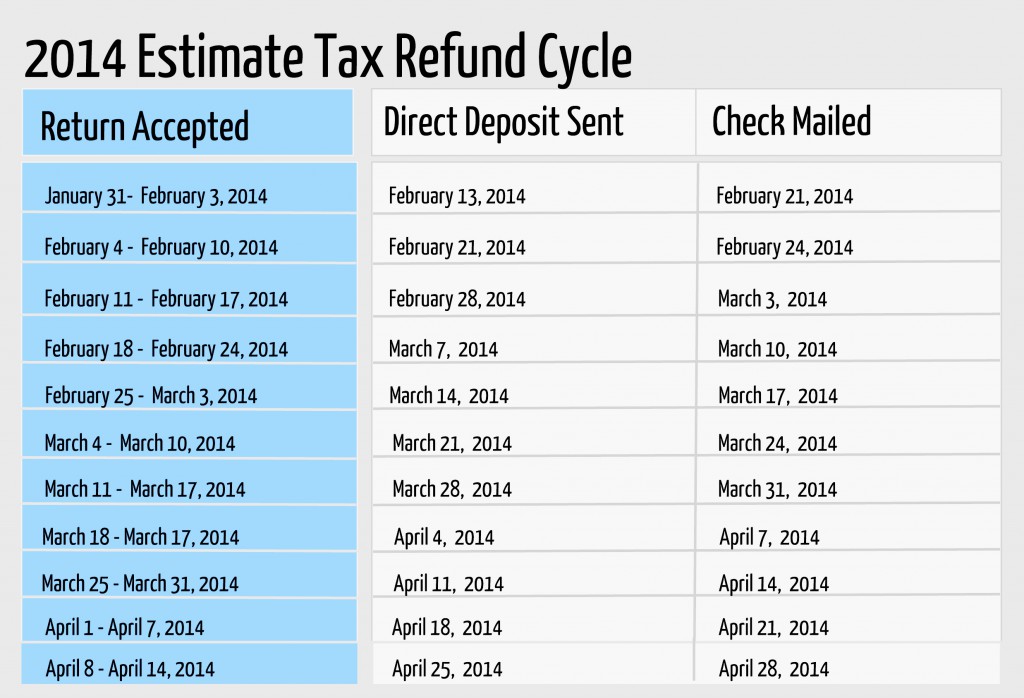

DATEucator - Your 2022 Tax Refund Date.

How To Calculate Gross Income Per Month The Motley Fool

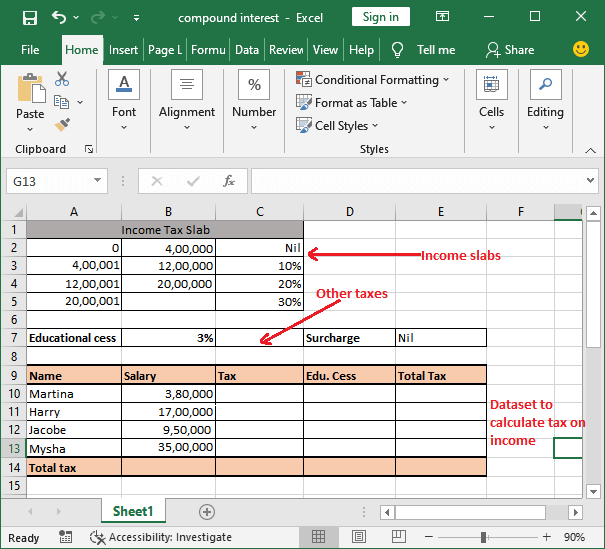

Income Tax Calculating Formula In Excel Javatpoint

How Is Taxable Income Calculated How To Calculate Tax Liability

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Tax Refund Estimator Cheap Sale Save 42 Srsconsultinginc Com

Tax Return Calc Deals Save 33 Srsconsultinginc Com

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Calculator And Estimator For 2023 Returns W 4 During 2022

Tax Return Calculator Online Save 41 Srsconsultinginc Com

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

What Are Marriage Penalties And Bonuses Tax Policy Center

Income Tax Calculating Formula In Excel Javatpoint

Best Tax Software Of September 2022 Forbes Advisor

/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

How To Calculate Return On Assets Roa With Examples

How To Calculate Your Federal Income Tax Liability Personal Finance Series Youtube

Excel Formula Income Tax Bracket Calculation Exceljet